Begin Your Smart Investment Journey.

Access expertly managed portfolios with a low initial investment, transparent fees, and automated management to help you achieve your financial goals effortlessly.

Dynamic Diversification

Invest in a diversified mix of low-cost ETFs and mutual funds tailored to your risk profile.

Transparent Fee Structure

Enjoy all-in annual costs starting from 0.85%, with no hidden fees or exit charges.

Automated Portfolio Management

Benefit from seamless automatic rebalancing and reinvestment of new funds for effortless growth.

For investment profiles to match your objectives.

Defensive portfolio

Preserving your capital is important, but you

are targeting performance higher than that

of traditional saving schemes.

Product details:

Moderate portfolio

You are prepared to accept more frequent

fluctuations in the value of your capital to achieve

higher performance.

Product details:

Growth portfolio

You are ready to take more risk

to achieve capital growth

over the long term.

Product details:

Fixed Income

Equity

Alternatives

What Are Smart Portfolios?

Smart Portfolios are designed to enhance your investment potential while managing risk. At LuxQuotes, we utilize advanced technology and expert insights to create diversified strategies tailored to your goals, using low-cost ETFs and mutual funds for broad asset exposure.

Our system automatically adjusts your portfolio based on market conditions, ensuring alignment with your risk profile. You also benefit from ongoing monitoring by our financial professionals, who make strategic adjustments to optimize performance.

Investment Portfolios Designed for Your Success.

Select from a range of portfolios that fit your investment style and risk appetite, ensuring you have the right strategy to achieve your financial goals and objectives.

Conservative Portfolio

Designed for risk-averse investors, this portfolio focuses on preserving capital while generating steady income.

Bonds

%

Stocks

%

Balanced Portfolio

This portfolio aims for moderate growth, combining stocks and fixed income to balance risk and return.

Stocks

%

Bonds

%

Cash

%

Growth Portfolio

This portfolio targets high returns for investors willing to accept more risk for significant capital appreciation.

ETFs

%

Stocks

%

Cash

%

Aggressive Portfolio

For high risk tolerance, this portfolio maximizes growth through aggressive stock and emerging market investments.

Stocks

%

Cash

%

Start investing with 100000 eur / usd / gbp / chf.

No hidden fees

All-in annual costs from 0.92%.

No entry or exit fees.

Cost efficient

Intelligently diversified

in low-cost ETFs and index funds.

Simple and flexible

Automatic rebalancing

and investment of new funds.

What Are Smart Portfolios?

Swissquote Smart Portfolios are designed to put your investments on track for the long-term. Choose a risk profile and a currency (EUR, GBP and USD), fund your account with minimum 100 000 EUR/USD/GBP then top it up at your convenience.

Your portfolio is professionally managed by a leading asset manager to ensure diversification, and regularly rebalanced to keep you invested in assets that match with the risk profile you have selected. And with online access to your account valuation, you will always know exactly where you stand.

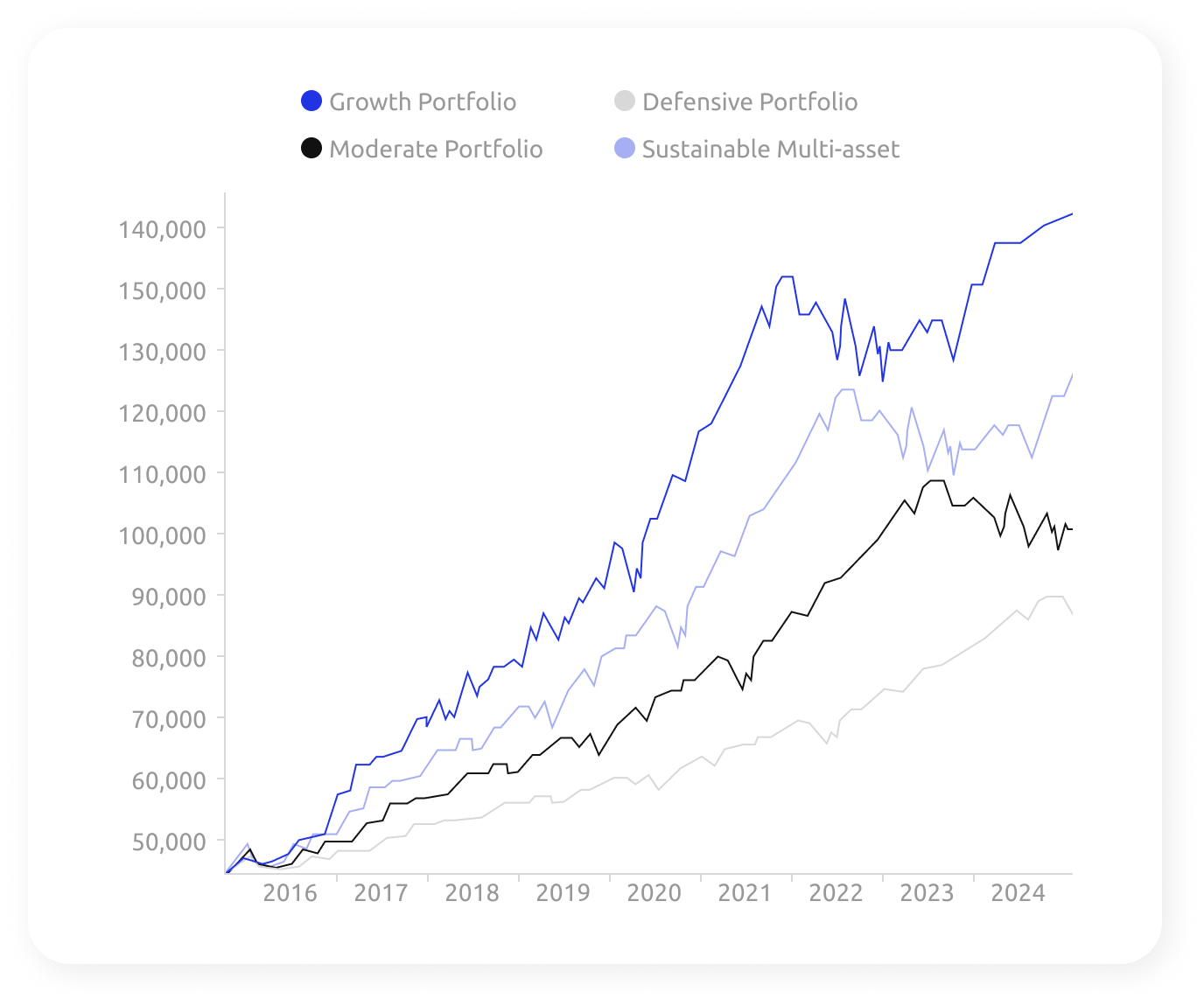

Investing can help you grow your money.

See how an initial investment of EUR 50'000 with monthly top ups of EUR 500 has performed, net of all fees, since October 2015.